Interest Rate Floor And Collar

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

The objective of the buyer of a collar is to protect against rising interest rates while agreeing to give up some of the.

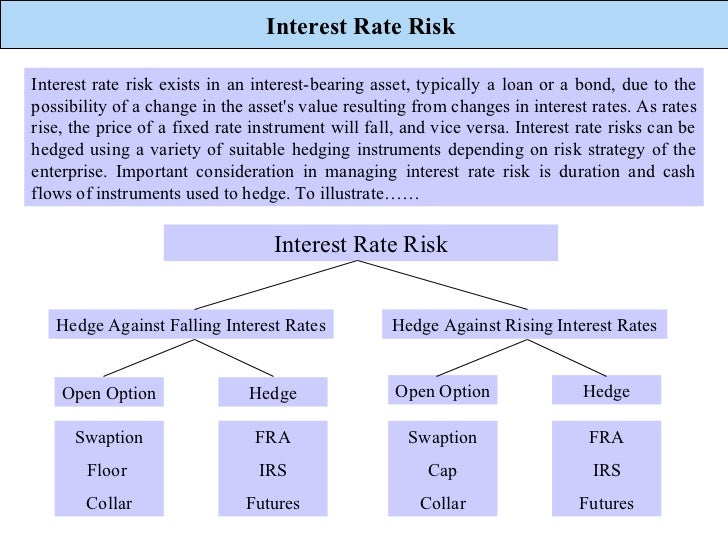

Interest rate floor and collar. Caps floors and collars 13 interest rate collars a collar is a long position in a cap and a short position in a floor. A collar involves using interest rate options to confine the interest paid or earned within a pre determined range. The cap rate is set above the floor rate. Interest rate floors are utilized in derivative.

An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product. If we are borrowing money then we can fix a maximum interest rate by buying a put option. In an interest rate collar the investor seeks to limit exposure to changing interest rates and at the same time lower its net premium obligations. A borrower would buy a cap and sell a floor thereby offsetting the cost of buying a cap against the premium received by selling a floor.

An interest rate collar is the simultaneous purchase of an interest rate cap and sale of an interest rate floor on the same index for the same maturity and notional principal amount. A depositor would buy a floor and sell a cap. Whenever the interest rate is above 10 the investor will receive a payment from. For example as a borrower with current market rates at 6 you would pay more for an interest rate collar with a 4 floor and a 7 cap than a collar with a 5 floor and a 8 5 cap.

The issuer of a floating rate note might use this to cap the upside of his debt service and pay for the cap with a floor. Let s say an investor enters a collar by purchasing a ceiling with a strike rate of 10 and sells a floor at 8. This is a short article to explain what an interest rate collar is and how interest rate options may be used to create one. The premium for an interest rate collar depends on the rate parameters you want to achieve when compared to current market interest rates.

:max_bytes(150000):strip_icc()/GettyImages-180734345-ec5247651d704f57a7117eee952be492.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Zero_Cost_Collar_Apr_2020-01-3f7ffff9ccd84d9e8f93fa3cd72c8d4f.jpg)

/GettyImages-508210587-035f69f0bb23424287d09c3a93bf4735.jpg)