Irs Depreciation For Carpet

So carpet is depreciable over 5 years on the landlord s tax return because the secretary of the treasury in the real world meaning irs staff reporting to the secretary did a study and determined that carpets used by residential landlords have an anticipated useful life of more than 4 but less than 10 years that is 5 9 years.

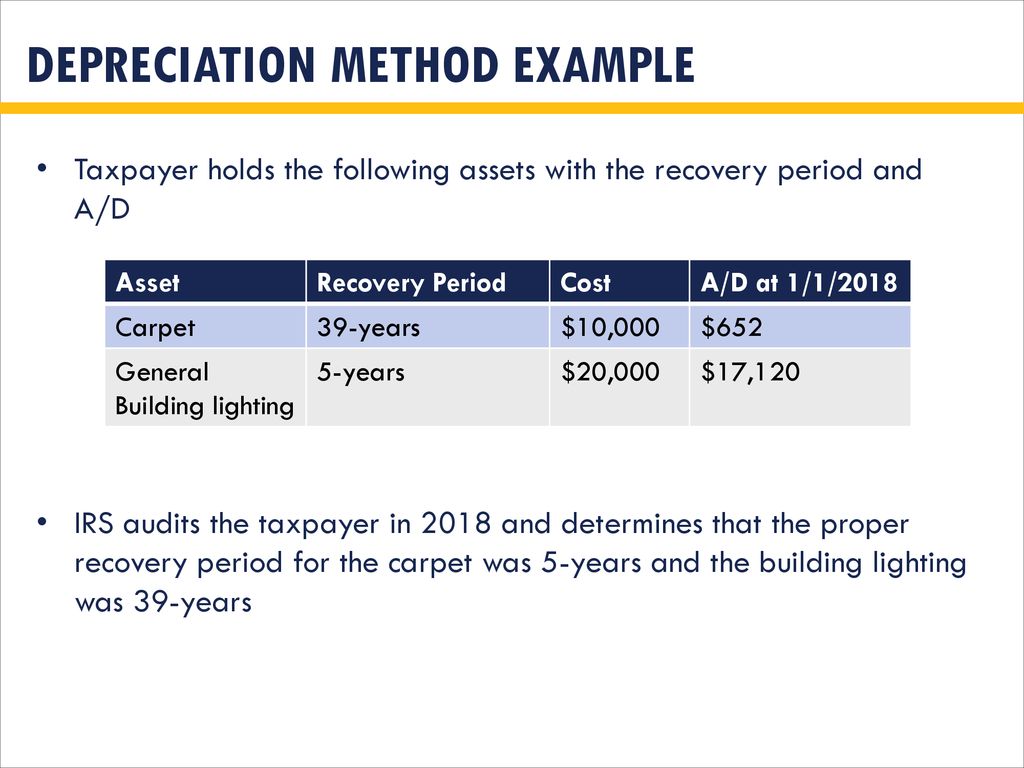

Irs depreciation for carpet. Instead you generally must depreciate such property. Internal revenue service publication 946 cat. These types of flooring include hardwood tile vinyl and glued down carpet. Carpeting is depreciated over either five years or 27 5 years depending on how it is installed.

Repairing is the key to your tax treatment replacing destroyed appliances carpet and linoleum are an asset and depreciated 5 years. Net investment income tax niit. Depreciation allowed is depreciation you actually deducted from which you received a tax benefit. Most repair costs that are results of the tenant destructive actions are fully tax deductible in the year incurred.

Niit is a 3 8 tax on the lesser of net in vestment income or the excess of modified ad. You deduct a part of the cost every year until you fully recover its cost. You may be subject to the net investment income tax niit. Depreciation is the recovery of the cost of the property over a number of years.

Most other types of flooring are depreciated using the 27 5 year schedule only. See irs gov form1040x for more information about amend ing a tax return. Tax year 2018 you will need to file an amended return form 1040 x to do so. If you do not claim depreciation you are entitled to deduct you must still reduce the basis of the property by the full amount of depreciation allowable.

Since these floors are considered to be a part of your rental. So while the property s income after accounting for expenses. 13081f how to depreciate property section 179 deduction special depreciation allowance macrs listed property for use in preparing 2019 returns get forms and other information faster and easier at. This applies however only to carpets that are tacked down.

Special depreciation allowance or a section 179 deduction claimed on qualified property. Like appliance depreciation carpets are normally depreciated over 5 years. Irs gov english irs gov spanish español irs gov chinese 中文. May 31 2019 4 47 pm repairing after a rental disaster.

In addition to these deductions the property would be entitled to an annual depreciation expense of 25 641 1 million divided by 39. Most flooring is considered to be permanently affixed.

/GettyImages-88305470-6152a026f81d4a9198db0eeb8cbca446.jpg)