Interest Rate Cap And Floor Investopedia

Time 0 5 6 004 0 470 4 721 0 021 35 0 06004 0 04721 0 470 0 021 ir modeling a capped floater consider an investor holding a 2 year.

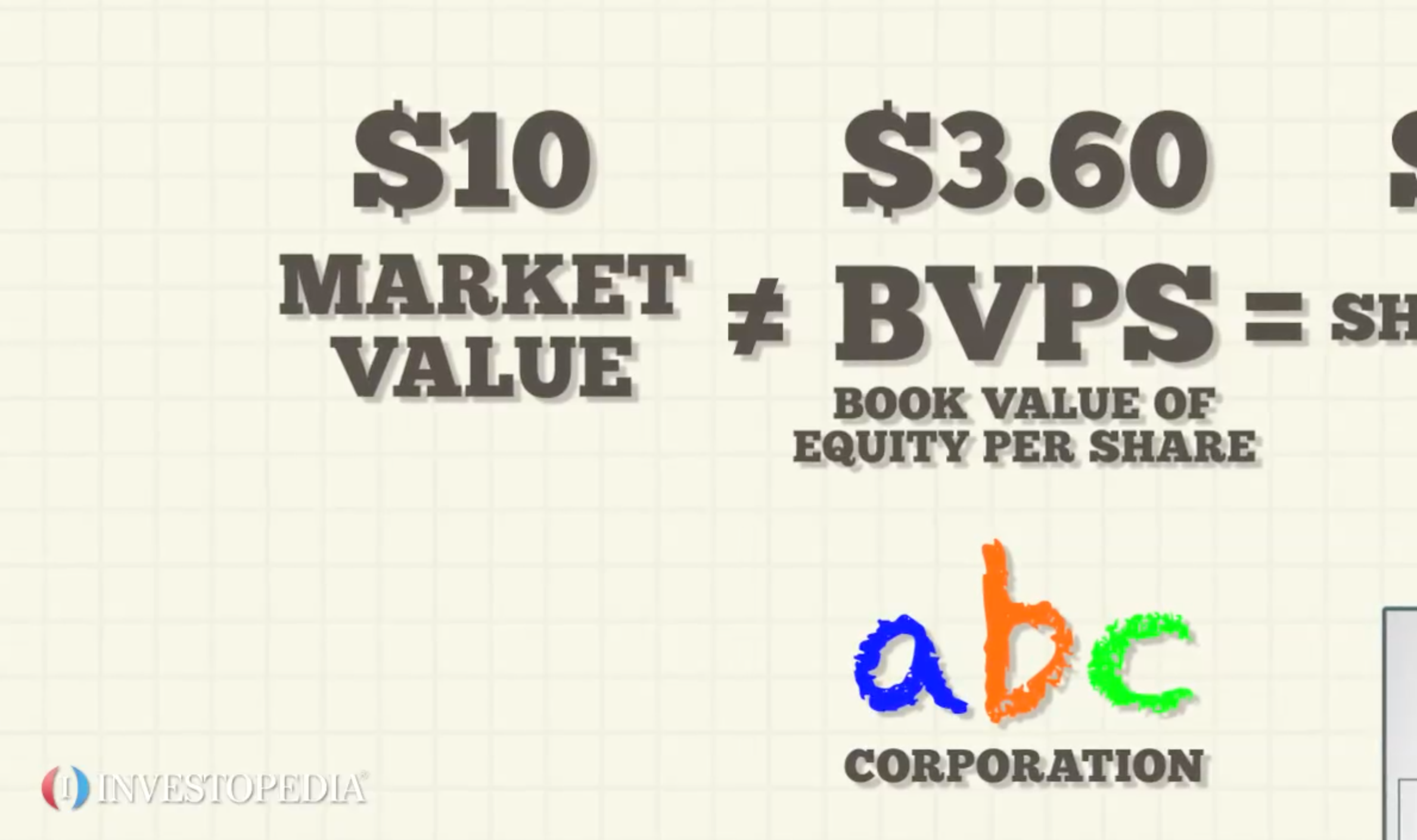

Interest rate cap and floor investopedia. As such the premiums payable for an interest rate collar are less than the premium payable for. Interest rate caps and floors are option like contracts which are customized and negotiated by two parties. The issuer typically. An investment in a derivative using an interest rate cap or floor requires the buyer to pay a premium to purchase the option so the buyer faces some form of credit risk.

Similarly an interest rate floor is a derivative contract in which the buyer receives payments at the end. Interest rate floors are utilized in derivative. Caps and floors are based on interest rates and have multiple settlement dates. An interest rate cap protects the buyer from interest rates rising above the strike rate.

You receive payment of a premium from st george to purchase the interest rate floor which offsets the premium that you pay for the interest rate cap. Caps and floors are based on interest rates and have multiple settlement dates a single data cap is a caplet and a single date floor is a floorlet. The floor guarantees a minimum rate to the buyer. The highest point to which an adjustable rate mortgage arm can rise in a given time period or the highest rate that investors can receive on a floating rate type bond.

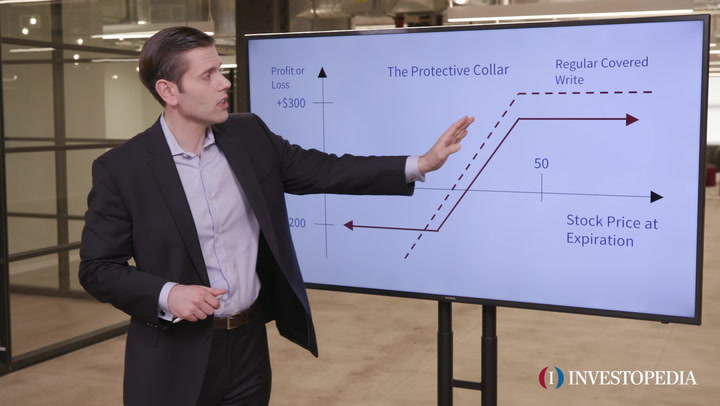

Therefore it is a bearish position in the bond market. An interest rate collar is simply a combination of an interest rate cap and an interest rate floor. It has value only when the rate is above the guaranteed rate otherwise it is worthless. A cap is an option.

An interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price an example of a cap would be an agreement to receive a payment for each month the libor rate exceeds 2 5. An interest rate cap is an otc derivative where the buyer receives payments at the end of each period when the interest rate exceeds the strike whereas an i. Interest rates standard options are caps and floors the cap guarantees a maximum rate to the buyer. Interest rate cap and floor an interest rate cap is a derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price.

Interest rate sensitivity of a cap the cap pays off when interest rates go up. Borrowers are interested by caps since they set a maximum paid interest cost.

:max_bytes(150000):strip_icc()/GettyImages-180734345-ec5247651d704f57a7117eee952be492.jpg)

/GettyImages-508210587-035f69f0bb23424287d09c3a93bf4735.jpg)

:max_bytes(150000):strip_icc()/LongPut2-3d94ffb6f6964e578b68c7ec25bd1acd.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Zero_Cost_Collar_Apr_2020-01-3f7ffff9ccd84d9e8f93fa3cd72c8d4f.jpg)

:max_bytes(150000):strip_icc()/VolatilitySmileDefinitionandUses2-6adfc0b246cf44e2bd5bb0a3f2423a7a.png)

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

:max_bytes(150000):strip_icc()/AnIntroductiontoStructuredProducts1-1a2eea05ef064d3fae32c8e1de618eaa.png)

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Trade_Stocks_That_Hit_All-Time_Highs_Jul_2020-01-d761dea2844f4b028c646429958053df.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Knock_In_Option_Apr_2020-01-ea2e95a4d5af4c96aa23b7c3e185f498.jpg)

:max_bytes(150000):strip_icc()/FourStepstoBuildingaProfitablePortfolio-171c087dc41f40269547e95a0b60eab5.png)

:max_bytes(150000):strip_icc()/VolatilitySkew2-17197b230fb84ea9ae62955e956ffe0c.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Evaluating_the_Board_of_Directors_Feb_2020-01-e4e970ac854b40c094ddba1e007e1e09.jpg)

:max_bytes(150000):strip_icc()/dotdash_FINAL_Diversification_Its_All_About_Asset_Class_Jan_2020-fe0eea99d53d4883824b1859f899627c.jpg)

/investment-3999136_1920-7e692563c3ea473d968c27d90ba7c5c6.jpg)

:max_bytes(150000):strip_icc()/symbol-1757582_1920-bf9423ed95d84812910b7298caad746c.png)

.png)

:max_bytes(150000):strip_icc()/GettyImages-182177306-5824a9a21fc0454b9dfb377154dce991.jpg)

/stock_shares-172670504-e4f46c00bfb04f07a0c0a78a2ae8a387.jpg)

/world-currency-rates-483658563-e3ab32fba56f4d2489323f5a9f1de82f.jpg)

/GettyImages-1147331105-b6d11d4d59a445c0909f2c61510df139.jpg)

:max_bytes(150000):strip_icc()/GettyImages-923217650-24a136310fda43dea8ba9a2e6f675223.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1064821934-6a28ccd7276d4f389a0d30c370e7f266.jpg)

:max_bytes(150000):strip_icc()/488153381-5bfc38e746e0fb00517f9ce1.jpg)

/GettyImages-471097761-5840cf786b3140f8b1c829cfa50bd38a.jpg)

/188044056-5bfc391b46e0fb0083c43272.jpg)