Interest Rate Floor Spread

:max_bytes(150000):strip_icc()/dotdash_Final_Swap_Spread_Apr_2020-01-9ff4068939e742ca9cc066d6d7d481b3.jpg)

Bonds are fixed income securities through which an investor essentially loans the bond issuer capital for a defined period of time in exchange for a promise to repay the.

Interest rate floor spread. Several developed countries and regions embraced monetary policy incorporating the use of negative interest rates. In the case of sbi for instance while the existing borrowers will pay 10 5 interest of which 10 is the base rate and 0 5 is the spread new borrowers will end up paying only 0 25. Although an interest rate floor bond call option or rates put option limits the potential appreciation of a bond given a decrease in rates it provides upfront cash and generates premium income. Interest rate derivatives are the derivatives whose underlying is based on a single interest rate or a group of interest rates.

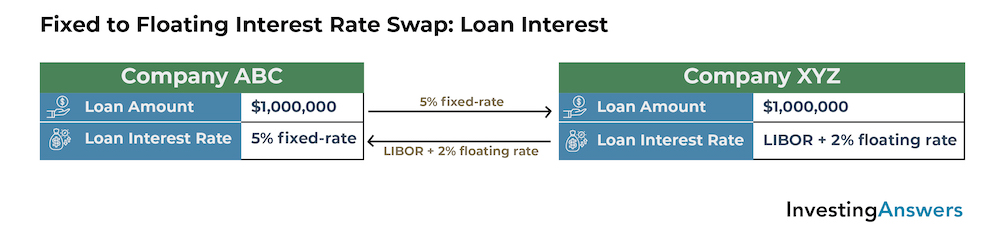

Interest rate swap interest rate vanilla swap floating interest rate swap credit default swap. Similarly an interest rate floor is a derivative contract in which the buyer receives payments at the end. Interest rate floors are utilized in derivative. An interest rate floor is an agreed upon rate in the lower range of rates associated with a floating rate loan product.

An interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price an example of a cap would be an agreement to receive a payment for each month the libor rate exceeds 2 5. Another 0 12 percent off when you set up automatic payments from a chase checking account. Bonds and term spreads. Base rate is the rate below which the bank cannot lend and spread is the margin based on customer and product specific factors.

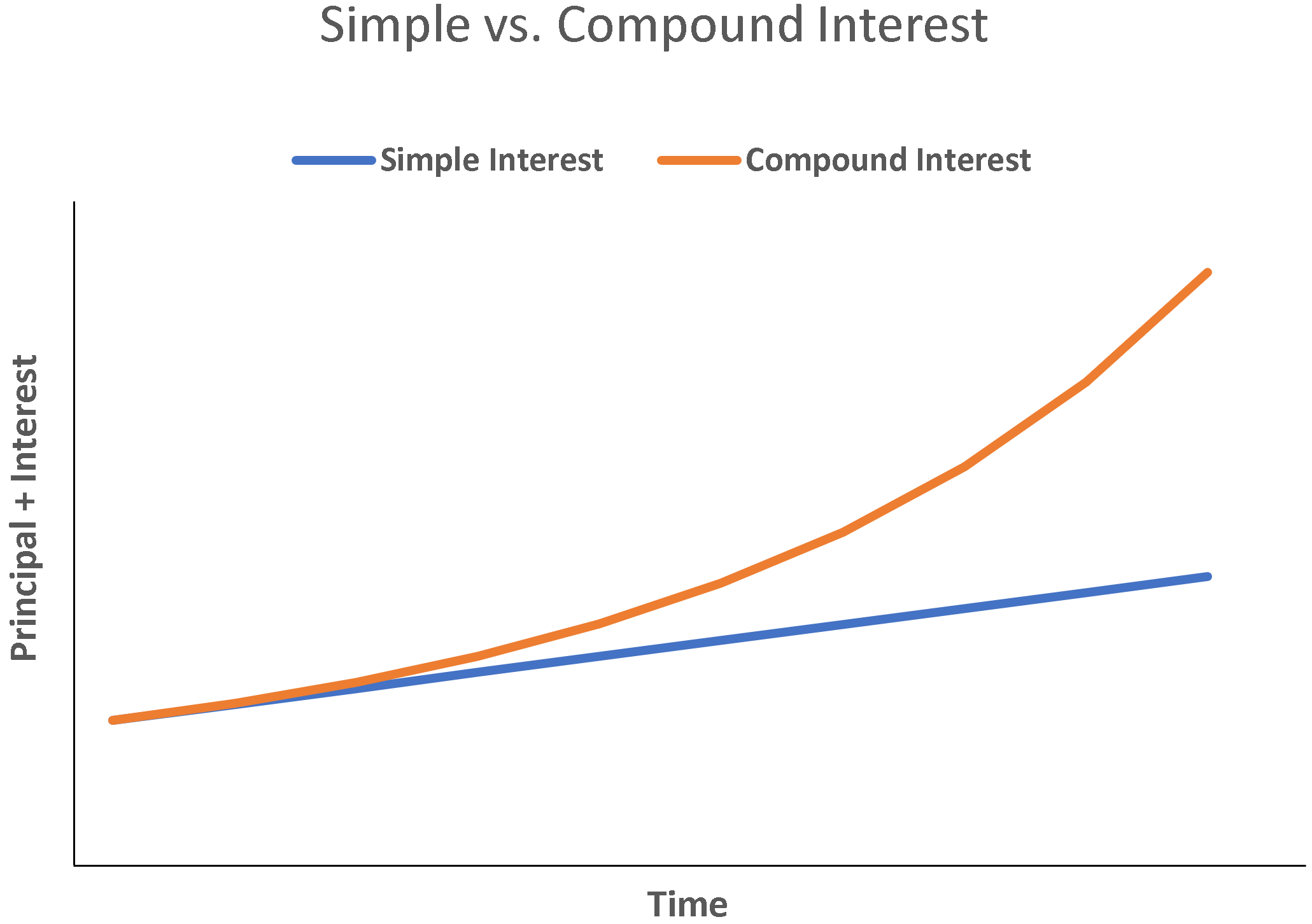

Term spreads are most often used in the comparison and evaluation of two bonds which are fixed interest financial assets issued by governments companies public utilities and other large entities. You should know what derivative security is if you are reading this material. Also known as floating rate debt. A bond or other type of debt whose coupon rate changes with market conditions short term interest rates.

The net interest rate spread is the difference between the average yield a financial institution receives from loans along with other interest accruing activities and the average rate it pays on. You can get 0 25 percent off your interest rate just for owning a qualified chase account. Avoiding the floor on negative rates.

:max_bytes(150000):strip_icc()/HowToReadInterestRateSwapQuotes1_4-ee013a308ef948ecb3ed106d6259a3f0.png)

:max_bytes(150000):strip_icc()/GettyImages-180734345-ec5247651d704f57a7117eee952be492.jpg)